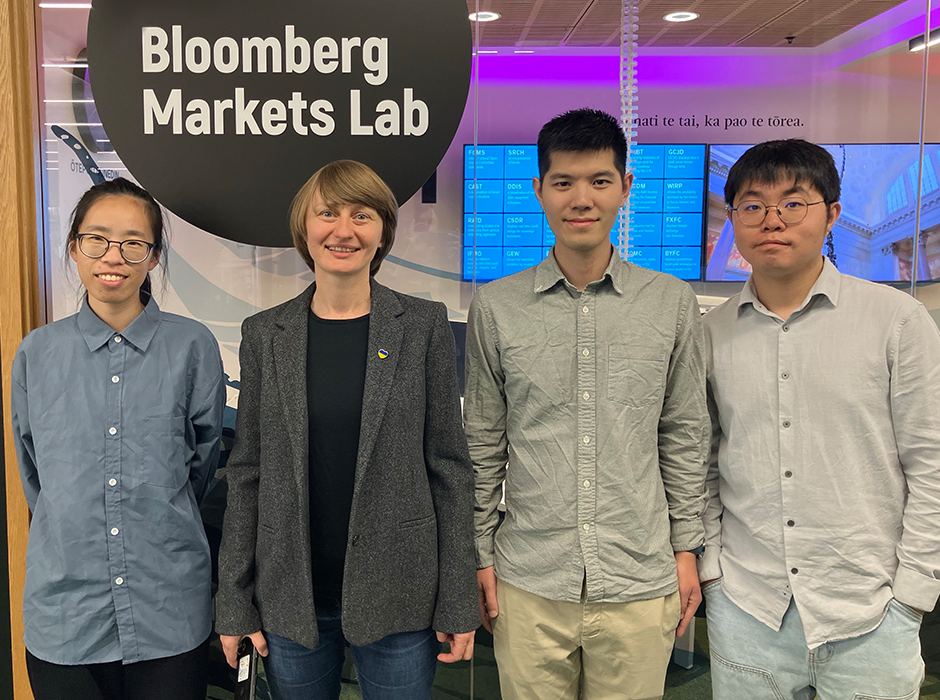

Team ‘Otago Alpha’ outside the Bloomberg trading terminals where all the deft financial manoeuvring happened. From left: Junxiu Lyu, Dr Olena Onishchenko, Shenjian Li and Mingxuan Yu.

Three doctoral students from the Otago Business School are feeling financially fit after proving their investing mettle on an international stage recently.

Shenjian Li (Finance), Mingxuan Yu (Finance) and Junxiu Lyu (Accountancy) took top honours among teams from the Australia/New Zealand region at the Bloomberg Global Trading Challenge 2024.

Finance Senior Lecturer Dr Olena Onishchenko mentored the students throughout the competition and gave them a suitably aspirational team name – ‘Otago Alpha’ (in finance, ‘alpha’ refers to the outperformance of a benchmark).

“We were the only New Zealand university to participate in the challenge. We competed with 2,453 teams from 383 universities and schools in 46 countries. We rated first out of five universities in the Australia/New Zealand region,” Olena says.

Each team was given US$1 million of notional capital to trade at the outset of the challenge. Otago Alpha prepared for their stewardship by testing various trading strategies ahead of the competition and developing a return-generating approach.

“We’re lucky to have the Bloomberg Market Lab at the Otago Business School. It makes it very easy to analyse companies and market trends. We can easily access information about a company’s earnings, sales, analyst reports and news articles on one platform,” Olena says.

Otago Alpha’s strategy was to buy five carefully chosen stocks, invest US $200,000 in each, hold them for the duration, sell them to take profits, and buy other stocks. It proved highly effective, generating profits of US$101,110.

“Outperforming the market by that much in just five weeks is impressive. The students demonstrated great real-world professional trading skills. They made significant returns while managing risk well. This sort of hands-on, real-world experience prepares our students well to compete for finance jobs,” Olena says.

Otago Emeritus Professor (Finance) Timothy Falcon Crack also had high praise for this team.

"This investment performance is excellent. It’s the sort of performance that professional hedge fund managers would like to obtain in their funds.”

Junxiu says though that million-dollar sum was fictional, it felt tangible enough to Otago Alpha.

“Although it wasn’t real money, we still had to look for real-world information using the Bloomberg terminals to capture the most recent data to make our decisions – and we could only buy and sell stocks in the Bloomberg Lab.”

Olena says the students had to learn how to navigate moments of jeopardy and hold their nerve – by not selling – during market turmoil.

“During the second week of the challenge, the stock price dropped by 10 per cent. The students walked into my office looking very worried. They asked if they should reduce the amount of capital invested. This reaction is common among traders at the beginning of their trading journey. Facing losses often triggers a desire to run to safety.”

Shenjian recalls that portfolio volatility – as team captain he’d keep a nocturnal eye on the US stock markets so that he and his team had time to get to the Bloomberg Lab before the trading period closed.

“Sometimes I’d wake up in the middle of the night and check and think OK, it’s good and go back to sleep. But one day I woke up and saw we had 15 per cent losses. I was really nervous so I sent an email to Olena asking of we should reduce our size of this stock. She said just stick to your strategy – don’t be disturbed by your emotion.”

Nervous tension aside, the Otago Alpha team loved every fraught minute of it, Mingxuan says.

“It was very exciting. It made me feel like a professional trader managing money. It was like a booster to our career.”

Asked if they’re keen to do it again next year, Shenjian gives the sort of numerically confident answer you’d expect of a good trader - “100 per cent”.

Kōrero by Claire Finlayson, Communications Adviser (Otago Business School)